Gold vs Bitcoin: A Tale of Two Stores of Value

Related Articles: Gold vs Bitcoin: A Tale of Two Stores of Value

- Digital Gold Investment

- Gold-backed Cryptocurrencies

- Gold Price Analysis

- Gold As Inflation Hedge

- Gold Supply Chain 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Gold vs Bitcoin: A Tale of Two Stores of Value. Let’s weave interesting information and offer fresh perspectives to the readers.

Gold vs Bitcoin: A Tale of Two Stores of Value

For millennia, gold has reigned supreme as the ultimate store of value. Its inherent scarcity, durability, and aesthetic appeal have cemented its position as a safe haven asset, a hedge against inflation, and a symbol of wealth and power. However, in the 21st century, a new contender has emerged, challenging gold’s dominance: Bitcoin. This decentralized digital currency, born from the ashes of the 2008 financial crisis, has captivated investors and technologists alike with its revolutionary potential. But which asset truly reigns supreme as a store of value in the modern age? This comprehensive analysis delves into the strengths and weaknesses of both gold and Bitcoin, exploring their historical context, underlying mechanics, and future prospects.

Gold: A Timeless Treasure

Gold’s allure stems from its intrinsic qualities. Its scarcity, determined by geological limitations, ensures its value remains relatively stable over long periods. Unlike fiat currencies, which are subject to the whims of central banks and governments, gold’s value is largely independent of political or economic manipulation. This inherent stability has made it a preferred asset for preserving wealth across generations.

Historically, gold has served as a medium of exchange, a store of value, and a unit of account. Its use as currency dates back to ancient civilizations, and its role in international finance persisted until the Bretton Woods system’s collapse in the 1970s. Even today, central banks hold significant gold reserves, reflecting its enduring importance in the global financial system.

The Advantages of Gold:

- Tangibility: You can physically hold gold, offering a sense of security and control that digital assets lack.

- Proven Track Record: Gold has a long and consistent history as a store of value, weathering economic storms for centuries.

- Decentralization (to an extent): While gold markets are regulated, the physical asset itself is not subject to the control of any single entity.

- Hedge Against Inflation: Gold often appreciates in value during periods of high inflation, acting as a safe haven.

- Global Acceptance: Gold is widely recognized and accepted as a valuable commodity worldwide.

The Disadvantages of Gold:

- Storage and Security: Storing and securing large quantities of gold can be expensive and pose security risks.

- Illiquidity: Converting large amounts of gold into cash can take time and may involve significant transaction costs.

- Volatility: While generally stable over the long term, gold prices can fluctuate significantly in the short term, impacting its attractiveness as a liquid investment.

- Limited Returns (compared to other assets): Gold’s returns can lag behind other asset classes, particularly during periods of strong economic growth.

- Environmental Concerns: Gold mining has significant environmental consequences, including habitat destruction and water pollution.

Bitcoin: The Digital Gold Rush

Bitcoin, created by the pseudonymous Satoshi Nakamoto in 2009, represents a radical departure from traditional finance. This decentralized cryptocurrency operates on a blockchain technology, a distributed ledger that records all transactions transparently and securely. Its limited supply of 21 million coins, combined with its growing adoption, fuels its potential as a store of value.

Bitcoin’s decentralized nature is its most significant advantage. It is not subject to government control or manipulation, making it attractive to those seeking an alternative to traditional financial systems. Its scarcity, similar to gold, contributes to its value proposition as a deflationary asset. Furthermore, Bitcoin’s transparency and immutability offer enhanced security compared to traditional financial systems.

The Advantages of Bitcoin:

- Decentralization: Not subject to government or central bank control, providing greater financial freedom.

- Transparency: All transactions are publicly recorded on the blockchain, enhancing accountability.

- Security: Cryptographic techniques secure Bitcoin transactions, making them highly resistant to fraud.

- Global Accessibility: Bitcoin can be accessed anywhere with an internet connection.

- Potential for High Returns: Bitcoin’s price has experienced significant growth since its inception, attracting investors seeking high returns.

The Disadvantages of Bitcoin:

- Volatility: Bitcoin’s price is notoriously volatile, subject to significant price swings, making it a high-risk investment.

- Complexity: Understanding and using Bitcoin can be complex for those unfamiliar with cryptocurrency technology.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty for investors.

- Security Risks: Although blockchain is secure, users are still vulnerable to hacking and theft if they lose their private keys.

- Environmental Impact: Bitcoin mining requires significant energy consumption, raising environmental concerns.

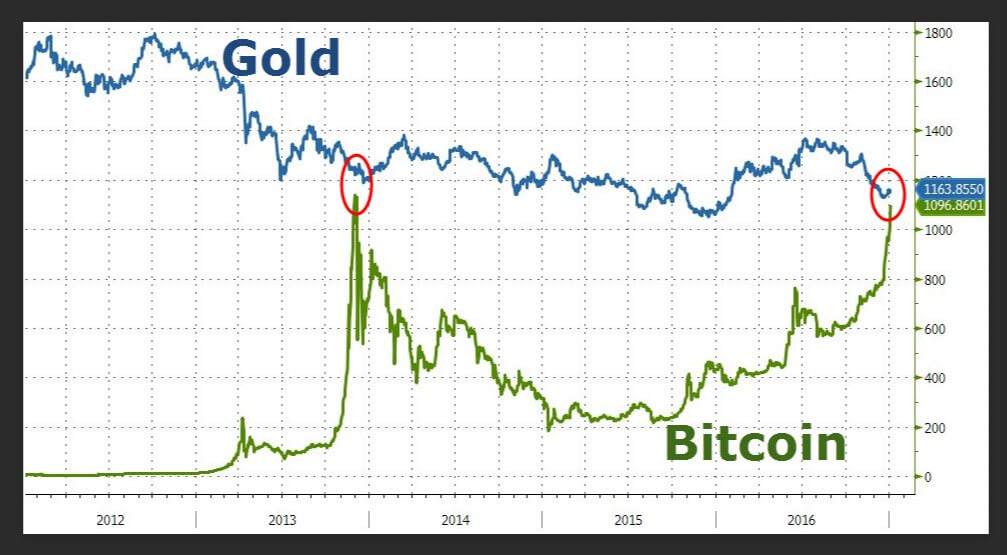

Gold vs. Bitcoin: A Comparative Analysis

Comparing gold and Bitcoin directly requires considering multiple factors. Both assets offer unique value propositions as stores of value, but their characteristics differ significantly. Gold offers tangibility, a long-standing track record, and relative stability, while Bitcoin offers decentralization, transparency, and the potential for high returns.

| Feature | Gold | Bitcoin |

|---|---|---|

| Tangibility | Tangible | Intangible |

| History | Centuries-old store of value | Relatively young asset |

| Scarcity | Geologically limited | Programmatically limited (21 million) |

| Decentralization | Partially decentralized | Highly decentralized |

| Volatility | Relatively low (long term) | Highly volatile |

| Liquidity | Moderate | Increasing, but still limited |

| Regulation | Regulated | Evolving regulatory landscape |

| Security | Secure (physical security concerns) | Secure (cryptographic) |

The Future of Gold and Bitcoin

The future of both gold and Bitcoin remains uncertain yet intriguing. Gold’s enduring appeal as a safe haven asset is likely to continue, especially during times of economic uncertainty. However, its limited returns and challenges in modern finance may hinder its adoption by younger generations.

Bitcoin, on the other hand, faces significant challenges, including its volatility and regulatory uncertainty. However, its underlying technology and growing adoption suggest a potential future as a significant store of value and a medium of exchange. The evolution of blockchain technology and the development of institutional-grade crypto solutions could further enhance Bitcoin’s appeal and stability.

Conclusion:

Gold and Bitcoin represent distinct approaches to wealth preservation. Gold offers a traditional and time-tested approach, while Bitcoin offers a revolutionary, technologically advanced alternative. The optimal choice depends on individual risk tolerance, investment goals, and understanding of each asset’s characteristics. Investors may even find value in a diversified portfolio including both gold and Bitcoin, capitalizing on the unique strengths of each asset class. The ongoing evolution of both gold and Bitcoin ensures a fascinating and dynamic landscape for investors in the years to come. The best strategy is continuous education and a thorough understanding of the inherent risks and rewards associated with each investment.

Closure

Thus, we hope this article has provided valuable insights into Gold vs Bitcoin: A Tale of Two Stores of Value. We thank you for taking the time to read this article. See you in our next article!