Global Gold Demand: A Country-by-Country Deep Dive

Related Articles: Global Gold Demand: A Country-by-Country Deep Dive

- Daily Wear Gold Necklaces That Add Subtle Glamour

- Gold Market News

- Gold As Inflation Hedge

- How to Layer Gold Necklaces Like a Fashion Pro

- Gold Necklace Trends 2025: What’s In and What’s Out

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Global Gold Demand: A Country-by-Country Deep Dive. Let’s weave interesting information and offer fresh perspectives to the readers.

Global Gold Demand: A Country-by-Country Deep Dive

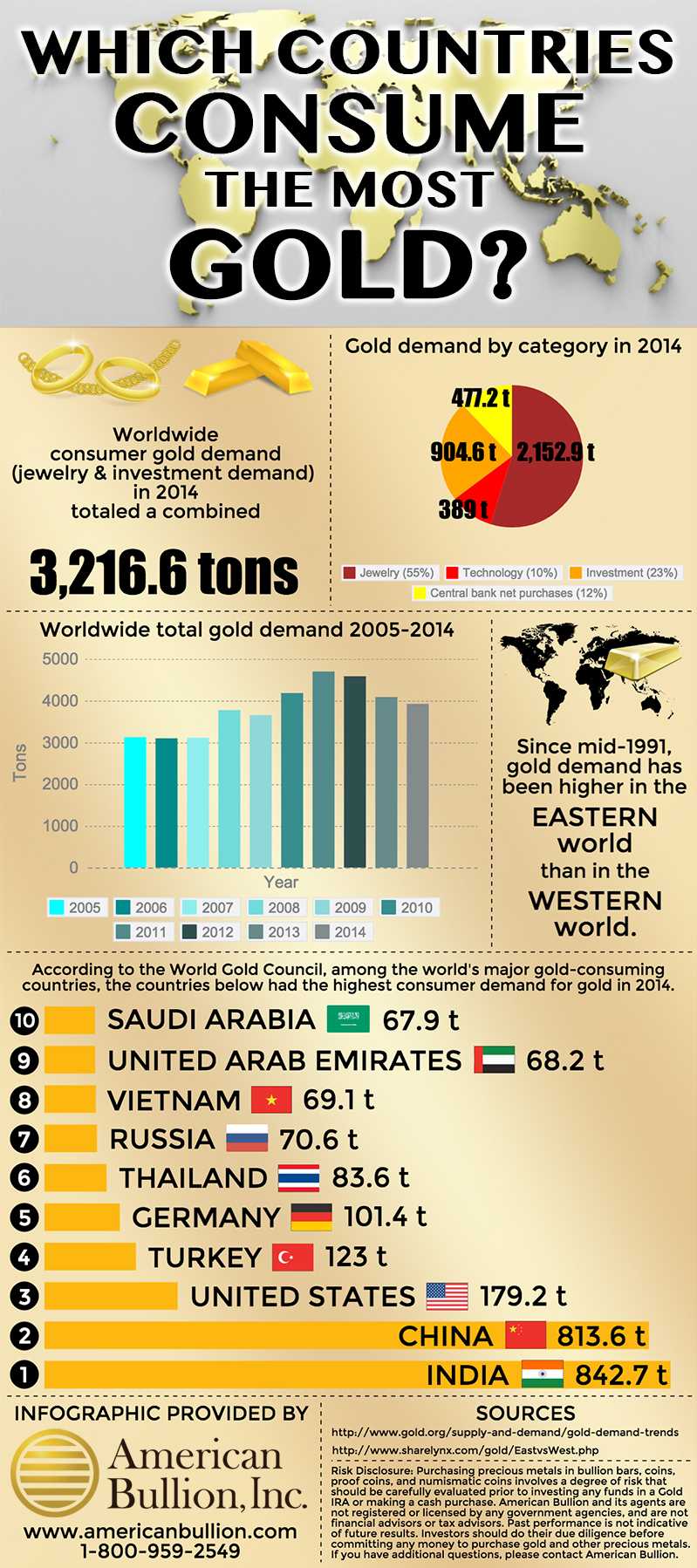

Gold, a timeless symbol of wealth, stability, and luxury, continues to fascinate and intrigue investors and consumers worldwide. Its enduring appeal transcends geographical boundaries, leading to a diverse and dynamic global gold market. Understanding the nuances of gold demand across different countries provides crucial insights into macroeconomic trends, investor sentiment, and cultural preferences. This in-depth analysis explores the key drivers of gold demand in various nations, revealing the complex interplay of economic factors, geopolitical events, and social customs.

India: The King of Gold Consumption

India, a land steeped in gold’s cultural and religious significance, reigns supreme as the world’s largest consumer of gold. Gold is deeply ingrained in Indian traditions, forming an integral part of weddings, festivals, and religious ceremonies. Demand patterns often follow seasonal trends, escalating during auspicious occasions like Diwali and Akshaya Tritiya. However, economic factors exert a significant influence. Fluctuations in the rupee’s value against the dollar can dramatically impact affordability and, consequently, gold consumption. Government policies, including import duties and taxes, also play a considerable role in shaping India’s overall demand. The rise of the middle class and increasing disposable incomes have further fueled gold’s popularity as an investment and a store of value. Furthermore, the preference for physical gold, particularly in the form of jewelry and bars, distinguishes the Indian market from others.

China: A Rising Giant

China, the world’s second-largest economy, follows closely behind India in terms of gold consumption. While not as deeply embedded in cultural traditions as in India, gold occupies a significant position within the Chinese investment landscape. The demand is driven by several factors including: increasing affluence, a growing preference for tangible assets, and a robust savings culture. The Chinese government’s policies regarding gold ownership and investment also influence market dynamics. China’s gold reserves have been steadily increasing, reflecting the government’s strategic interest in diversifying its foreign exchange reserves. Unlike India, where jewelry accounts for a considerable share of demand, China’s gold consumption is more diversified, encompassing jewelry, bars, and coins.

United States: A Mature Market with Diversified Demand

The United States represents a mature gold market characterized by diversified demand sources. The US gold market is influenced by a unique mix of factors: investor sentiment, industrial applications, and central bank activity. The US Federal Reserve’s policies significantly impact gold prices and investor behavior. Periods of economic uncertainty or inflationary pressures typically lead to increased gold investment. The significant presence of institutional investors, such as hedge funds and investment banks, adds another layer of sophistication to the US gold market. The robust jewelry market, though smaller compared to India and China, complements other categories such as investment demand.

Other Key Players: A Global Perspective

Beyond the aforementioned giants, several other countries showcase noteworthy gold demand patterns:

-

Switzerland: Renowned for its gold refining and trading activities, Switzerland serves as a vital hub in the global gold market. Its demand is driven by a combination of investment, industrial, and re-export activities.

-

Turkey: Similar to India, Turkey has a strong cultural affinity for gold, with jewelry representing a large portion of the demand. Economic conditions and currency fluctuations have a significant impact on Turkish gold consumption.

-

Germany: Germany’s gold demand is driven by both private investment and central bank holdings. The German Bundesbank’s repatriation of gold reserves has signaled renewed confidence in physical gold as an asset.

-

United Arab Emirates (UAE): The UAE serves as a major gold trading and retail center, attracting demand from both regional and international sources. Jewelry is a dominant driver of consumption.

-

South Africa: Historically a significant gold producer, South Africa’s demand incorporates both domestic consumption and investment interest.

Factors Influencing Global Gold Demand

Several overarching factors influence gold demand across the globe:

-

Economic Uncertainty: Periods of economic instability, inflation, or geopolitical tensions often lead to increased gold investment, as investors seek safe haven assets.

-

Currency Fluctuations: Changes in exchange rates can significantly impact the affordability of gold in different countries, thereby influencing demand.

-

Government Policies: Regulatory measures, such as import duties, taxes, and investment regulations, can shape the gold market within a nation.

-

Cultural and Religious Traditions: In many cultures, gold plays a significant role in social and religious practices, driving demand for jewelry and other gold items.

-

Investment Sentiment: Investor attitudes towards gold, influenced by market trends and economic forecasts, significantly impact demand.

The Future of Global Gold Demand

Predicting future gold demand is inherently challenging due to the complex interplay of economic, geopolitical, and socio-cultural factors. Yet, certain trends suggest a continued, albeit possibly evolving, demand for gold across various countries. The expanding middle class in emerging economies will likely drive increased consumption, particularly in Asia. The ongoing uncertainty in the global economy and financial markets may further bolster gold’s allure as a safe-haven investment. Technological advancements and evolving consumer preferences may impact distribution channels and product formats, but the intrinsic value and appeal of gold are expected to remain robust.

Conclusion: A Diverse and Dynamic Market

Global gold demand is a multifaceted phenomenon, driven by a complex interplay of several factors including cultural preferences, economic conditions, and geopolitical events. Understanding the nuances of gold demand in individual countries is crucial for investors, traders, and policymakers alike. While the dominance of India and China in terms of consumption is undeniable, the diverse drivers of demand across other nations ensures that the global gold market remains a dynamic and fascinating area of study. As the world navigates economic uncertainties and evolving geopolitical landscapes, the enduring appeal of gold is likely to remain a significant factor in the global financial system.

Closure

Thus, we hope this article has provided valuable insights into Global Gold Demand: A Country-by-Country Deep Dive. We thank you for taking the time to read this article. See you in our next article!