Gold as an Inflation Hedge: A Deep Dive into the Precious Metal’s Role in Protecting Your Wealth

Related Articles: Gold as an Inflation Hedge: A Deep Dive into the Precious Metal’s Role in Protecting Your Wealth

- Future Of Gold Investment

- Top 5 Types of Gold Necklaces and How to Style Them

- How to Layer Gold Necklaces Like a Fashion Pro

- How to Choose the Perfect Gold Necklace for Your Face Shape

- Gold Market Forecast

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Gold as an Inflation Hedge: A Deep Dive into the Precious Metal’s Role in Protecting Your Wealth. Let’s weave interesting information and offer fresh perspectives to the readers.

Gold as an Inflation Hedge: A Deep Dive into the Precious Metal’s Role in Protecting Your Wealth

Inflation, the insidious erosion of purchasing power, is a persistent threat to financial security. As prices rise, the value of your savings diminishes, leaving you with less capacity to acquire goods and services. In this environment, investors constantly search for assets that can preserve and even enhance their wealth against the ravages of inflation. One such asset, steeped in history and mythology, stands as a potential bulwark: gold.

This article delves into the multifaceted relationship between gold and inflation, exploring its historical performance, inherent characteristics, and the complexities of relying on it as a sole inflation hedge. We will examine the arguments for and against its effectiveness, considering various economic factors and market dynamics that influence its price.

Gold’s Historical Performance Against Inflation:

Throughout history, gold has demonstrated a remarkable correlation with inflation. During periods of economic uncertainty and rising inflation, the demand for gold often increases, pushing its price upward. This is because gold is considered a safe-haven asset—a store of value that holds its worth even when other assets decline. Investors flock to gold as a tangible asset during times of distress, seeking to preserve their capital from the debasement of fiat currencies.

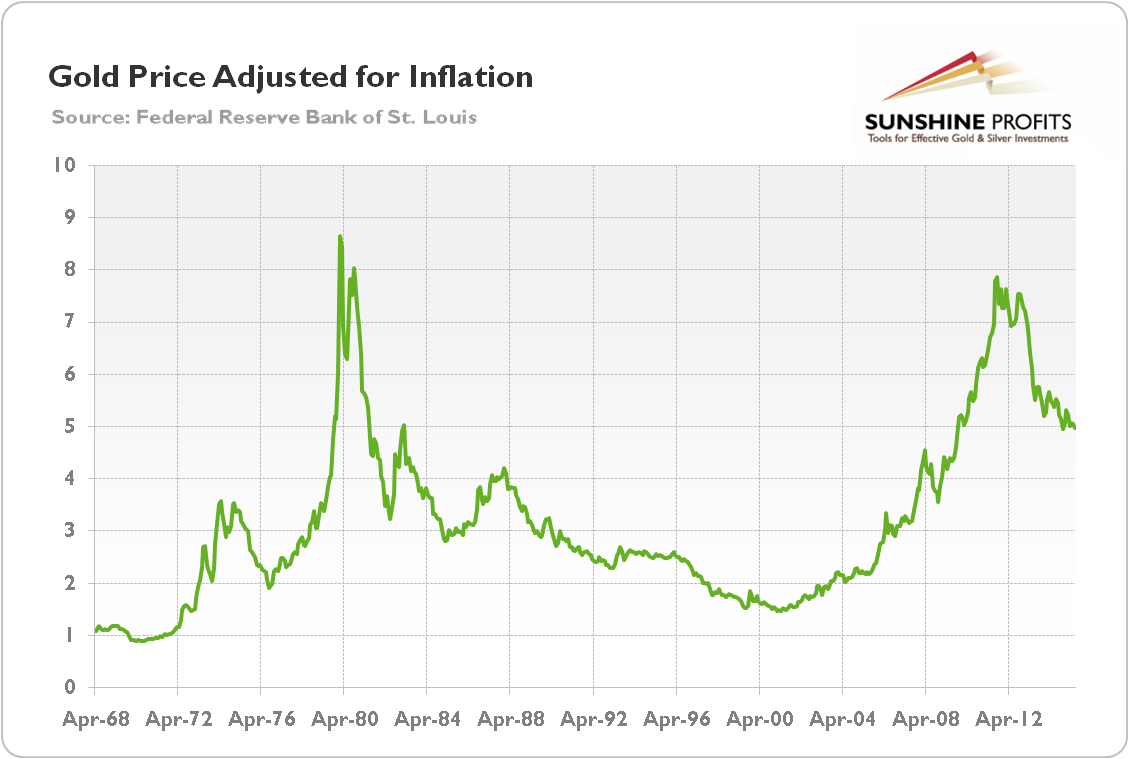

Numerous historical examples support this correlation. The inflationary spirals of the 1970s saw a dramatic rise in gold prices, mirroring the escalating cost of living. Similarly, during periods of global financial crises, such as the 2008 financial crisis, gold’s price surged as investors sought refuge from the uncertainty in the financial markets. These historical trends underscore gold’s reputation as a reliable inflation hedge, offering a tangible counterbalance to the weakening purchasing power of paper money.

However, it’s crucial to acknowledge that gold’s price isn’t always directly proportional to inflation rates. Other factors, such as currency fluctuations, geopolitical events, and investor sentiment, significantly influence its price. While gold generally performs well during inflationary periods, it’s not immune to market volatility. There have been instances where inflation rose while gold prices remained relatively stagnant, or even declined, highlighting the complexity of predicting its price movements.

The Inherent Characteristics of Gold:

Gold’s unique properties contribute to its role as an inflation hedge. Its inherent scarcity, durability, and inherent beauty have made it a prized asset for millennia. Unlike fiat currencies subject to government manipulation and printing, gold’s supply is finite, limiting its potential for devaluation. Its resistance to corrosion and tarnish ensures its durability, making it a lasting store of value. Its aesthetic appeal further enhances its desirability as an investment and as a hedge against economic uncertainty.

Furthermore, gold is globally recognized and traded, ensuring its liquidity. Investors can readily buy and sell gold in various forms, including coins, bars, and exchange-traded funds (ETFs), reducing the risk of illiquidity. This liquidity allows investors to quickly convert gold into other assets if needed, providing flexibility during periods of market volatility.

The Arguments for Gold as an Inflation Hedge:

-

Safe-Haven Asset: Gold’s status as a safe-haven asset during times of economic uncertainty and rising inflation is well-established. Investors seek its protection when traditional assets underperform, making it a crucial component of diversified investment portfolios.

-

Tangible Asset: Unlike digital assets or stocks, gold is a tangible asset that you can physically possess. This characteristic offers a sense of security and control, particularly during periods of economic instability.

-

Decentralized Nature: Gold is not subject to the control of any single government or institution, shielding it from the risks associated with central bank policies and political instability.

-

Historical Performance: As demonstrated by historical data, gold has often performed well during periods of inflation, providing a hedge against the erosion of purchasing power.

-

Limited Supply: Gold’s finite supply limits its potential for devaluation, making it a more stable store of value compared to fiat currencies that can be printed at will.

The Arguments Against Gold as an Inflation Hedge:

-

Volatility: While gold generally performs well during inflationary periods, its price can be volatile, influenced by various factors beyond inflation rates. This volatility can create uncertainty and risk for investors.

-

Opportunity Cost: Investing in gold means foregoing potential returns from other asset classes, such as stocks or real estate. This opportunity cost can be significant, especially during periods of strong economic growth.

-

Lack of Income Generation: Unlike income-producing assets like bonds or dividend-paying stocks, gold does not generate income. This can be a drawback for investors seeking regular cash flows.

-

Storage and Security Concerns: Storing and securing physical gold can be challenging and expensive, requiring specialized vaults or insurance.

-

Dependence on Market Sentiment: Gold’s price is influenced by market sentiment, which can be fickle and unpredictable. Negative sentiment can lead to price declines, regardless of inflationary pressures.

Gold as Part of a Diversified Portfolio:

While gold can be an effective tool in protecting against inflation, it’s crucial to understand that it’s not a standalone solution. It should be considered as part of a diversified investment portfolio, alongside other assets that offer different risk-reward profiles. A well-diversified portfolio can reduce overall risk and enhance the possibility of achieving long-term financial goals.

Conclusion:

Gold’s role as an inflation hedge is complex and multifaceted. While its historical performance and inherent characteristics suggest its effectiveness in preserving purchasing power during inflationary periods, it’s not a foolproof solution. Its volatility, opportunity cost, and lack of income generation should be carefully considered. Ultimately, the decision of whether or not to include gold in your investment portfolio depends on your individual risk tolerance, investment goals, and overall financial strategy. It’s advisable to consult with a qualified financial advisor to determine the appropriate allocation of gold within your portfolio. Gold’s position as a potential inflation hedge remains a powerful consideration in the world of finance, demanding its continued study and strategic integration within a broader investment framework.

Closure

Thus, we hope this article has provided valuable insights into Gold as an Inflation Hedge: A Deep Dive into the Precious Metal’s Role in Protecting Your Wealth. We appreciate your attention to our article. See you in our next article!