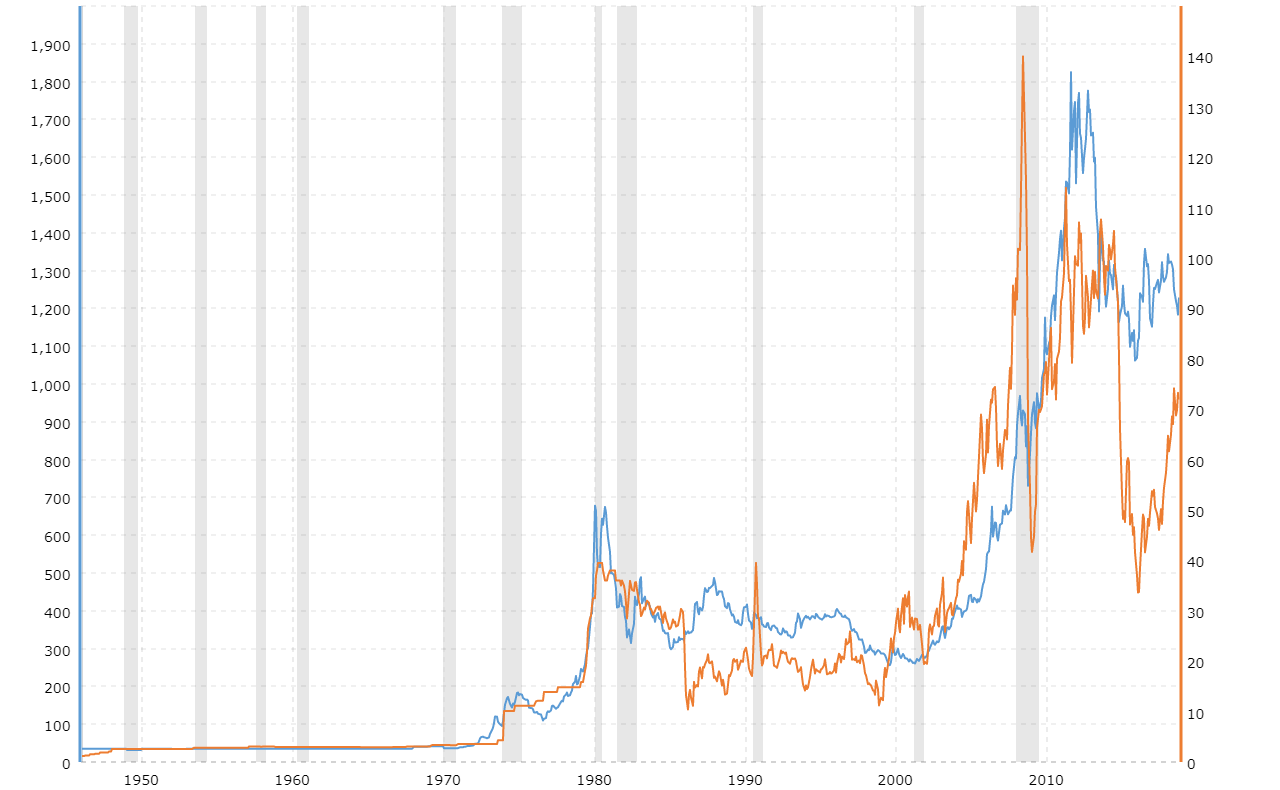

gold price vs oil price

Related Articles: gold price vs oil price

- Daily Wear Gold Necklaces That Add Subtle Glamour

- 10 Stunning Gold Necklace Designs You Need to See in 2025

- Gold Supply Chain 2025

- How to Choose the Perfect Gold Necklace for Your Face Shape

- Role Of Gold In Global Economy

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to gold price vs oil price. Let’s weave interesting information and offer fresh perspectives to the readers.

Here’s a draft of a 1600-word article about gold prices vs. oil prices, optimized for SEO. Remember to tailor it further with specific keywords based on your target audience and SEO analysis. I’ve included a variety of headings and subheadings to improve readability and SEO.

Gold vs. Oil: A Clash of Titans in the Commodities Market

The commodities market is a vast and volatile landscape, home to a diverse array of assets, each with its own unique characteristics and drivers. Among these, gold and oil stand out as two of the most prominent and influential commodities, shaping global economies and influencing investment strategies worldwide. While seemingly disparate – one a precious metal historically associated with stability, the other a crucial energy source driving global industry – their price movements are often intricately intertwined, reflecting broader macroeconomic trends and investor sentiment. This article delves into the complex relationship between gold and oil prices, exploring their individual drivers, their historical correlation (or lack thereof), and the implications for investors.

Understanding the Drivers of Gold Prices:

Gold, a safe-haven asset, has historically served as a hedge against inflation and economic uncertainty. Its price is influenced by a variety of factors:

-

Inflation: As inflation rises, the purchasing power of fiat currencies declines, making gold a more attractive store of value. This often leads to an increase in gold demand and consequently, its price.

-

Interest Rates: Inversely related to gold prices, higher interest rates typically reduce gold’s appeal. This is because higher rates make other investments, such as bonds, more attractive, diverting capital away from gold.

-

US Dollar: As the primary currency for global commodity trading, the US dollar’s strength significantly impacts gold prices. A stronger dollar typically puts downward pressure on gold prices, as it becomes more expensive for holders of other currencies to buy gold.

-

Geopolitical Uncertainty: Times of geopolitical instability or uncertainty often boost gold prices. Investors flock to gold as a safe haven during periods of conflict, economic crisis, or political upheaval.

-

Supply and Demand: Like any commodity, gold’s price is also influenced by the basic forces of supply and demand. Changes in gold mining production, jewelry demand, and central bank purchases all affect the price.

Deciphering the Dynamics of Oil Prices:

Oil, a critical energy source, is a cornerstone of the global economy. Its price is significantly more volatile than gold and is influenced by:

-

Supply and Demand: The fundamental driver of oil prices is the balance between global supply and demand. OPEC (Organization of the Petroleum Exporting Countries) plays a significant role in managing global oil supply, often influencing prices through production quotas.

-

Geopolitical Factors: Geopolitical events, such as wars, political instability in major oil-producing regions, and sanctions, can drastically disrupt oil supply, leading to price spikes.

-

Economic Growth: Global economic growth is directly correlated to oil demand. Strong economic growth typically translates into higher oil consumption and thus, higher prices.

-

Technological Advancements: The development and adoption of alternative energy sources and improvements in energy efficiency can influence oil demand and prices.

-

Speculation and Investment: Oil futures contracts are actively traded on global exchanges, and speculation plays a significant role in price volatility.

The Correlation Conundrum: Gold vs. Oil Price Movements

The relationship between gold and oil prices is complex and not always straightforward. While a negative correlation is often assumed – one rising while the other falls – the historical data shows a mixed picture.

-

Periods of Negative Correlation: During times of economic uncertainty or inflation, gold often acts as a safe haven, while oil prices might decline due to reduced economic activity. This results in a negative correlation.

-

Periods of Positive Correlation: In periods of strong economic growth, both gold and oil prices can move upward. Increased demand for both commodities, driven by a robust economy, can lead to a positive correlation.

-

Uncorrelated Periods: At times, gold and oil prices might exhibit little to no correlation. This is often due to the dominance of individual factors affecting each commodity, overshadowing any broader macroeconomic trends.

Investing in Gold and Oil: A Diversification Strategy

Given the complexities of their price movements, both gold and oil can play valuable roles in a diversified investment portfolio.

-

Gold as a Hedge: Gold’s role as a safe-haven asset makes it a valuable addition to a portfolio for hedging against inflation and economic downturns.

-

Oil as a Growth Play: Oil can be a growth investment in times of strong global economic expansion, but it carries significantly higher risk compared to gold due to its price volatility.

-

Diversification is Key: The contrasting price dynamics of gold and oil offer opportunities for portfolio diversification. Investors can benefit from their differing responses to economic conditions.

Analyzing Historical Price Trends:

A historical analysis of gold and oil prices reveals fascinating insights into their relationship. For example, periods of high inflation often correlate with rising gold prices but not necessarily with consistently rising oil prices, which might be influenced by supply-side factors. Studying historical data allows investors to better understand the nuances of their interaction and make more informed investment decisions.

Future Outlook and Predictions:

Predicting future gold and oil prices is inherently challenging due to the numerous factors influencing each commodity. However, certain trends can be considered:

-

Global Economic Growth: The trajectory of global economic growth will be a key determinant of both gold and oil prices.

-

Geopolitical Risks: Geopolitical events and instability will likely continue to significantly impact oil prices, while gold is likely to benefit from increasing uncertainty.

-

Technological Advancements: Renewable energy developments and technological advancements could decrease oil demand in the long term, potentially putting downward pressure on oil prices.

-

Inflationary Pressure: Persistently high inflation could drive increased gold demand, potentially pushing gold prices higher.

Conclusion:

The relationship between gold and oil prices is dynamic and intricate, reflective of the interplay between macroeconomic forces, geopolitical events, and investor sentiment. Understanding the individual drivers of each commodity, as well as their historical and potential future correlations, is crucial for navigating the complexities of the commodities market. A diversified investment strategy considering both gold and oil, recognizing their distinct characteristics and potential to move in different ways, offers a strategic approach to managing risk and capitalizing on opportunities presented by these two titans of the commodities world. Remember to conduct thorough research and seek professional advice before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into gold price vs oil price. We hope you find this article informative and beneficial. See you in our next article!