The Intricate Dance: How Interest Rates Sway the Gold Market

Related Articles: The Intricate Dance: How Interest Rates Sway the Gold Market

- Gold Mining Industry Trends

- Gold Market Forecast

- Gold Price Analysis

- Global Gold Demand

- Physical Gold Vs Digital Gold

Introduction

With great pleasure, we will explore the intriguing topic related to The Intricate Dance: How Interest Rates Sway the Gold Market. Let’s weave interesting information and offer fresh perspectives to the readers.

The Intricate Dance: How Interest Rates Sway the Gold Market

Gold, the timeless haven, has captivated investors for millennia. Its allure transcends mere aesthetics; it’s a hedge against inflation, a safe harbor during economic storms, and a tangible asset in a world increasingly dominated by digital currencies. But gold’s price isn’t set in isolation. It’s intricately woven into the fabric of global finance, particularly influenced by the ebb and flow of interest rates. Understanding this dynamic relationship is key to navigating the complexities of the gold market.

Interest Rates: The Maestro of Market Forces

Interest rates, the price of borrowing money, are a powerful lever wielded by central banks to influence economic activity. When rates are low, borrowing becomes cheaper, encouraging spending and investment, potentially fueling inflation. Conversely, higher rates make borrowing more expensive, dampening economic growth and potentially curbing inflation. This seemingly simple mechanism has profound consequences for the price of gold.

The Inverse Relationship: A Golden Rule (Mostly)

Historically, a strong inverse correlation exists between interest rates and gold prices. This means that as interest rates rise, gold prices tend to fall, and vice versa. This isn’t a rigid law, but rather a prevailing trend shaped by several intertwined factors:

-

Opportunity Cost: Gold is a non-yielding asset; it doesn’t pay interest. When interest rates are high, investors can earn a decent return on their money through interest-bearing instruments like bonds and savings accounts. This makes holding gold less attractive, as the opportunity cost of foregoing interest income becomes significant. Investors might sell their gold holdings to capitalize on higher interest rates, leading to a decrease in gold prices.

-

Dollar Strength: Interest rates often influence the value of a nation’s currency, primarily the US dollar, given its global dominance. Higher US interest rates typically attract foreign investment, increasing demand for the dollar and strengthening its value. Since gold is priced in US dollars, a stronger dollar makes gold more expensive for buyers holding other currencies, thus reducing demand and potentially lowering the gold price.

-

Inflation Expectations: While gold is often seen as an inflation hedge, the relationship isn’t always straightforward. High interest rates are often implemented to combat inflation. If investors believe the central bank’s actions will successfully curb inflation, the demand for gold as an inflation hedge might diminish, leading to lower prices. Conversely, if inflation persists despite higher interest rates, gold’s safe-haven appeal could strengthen, driving up demand and potentially offsetting the downward pressure from higher rates.

Beyond the Simple Inverse: Nuances and Exceptions

While the inverse relationship between interest rates and gold prices holds true in many cases, it’s not foolproof. Several factors can complicate this dynamic:

-

Geopolitical Uncertainty: During times of geopolitical instability, war, or major political upheaval, gold’s safe-haven status often overshadows the influence of interest rates. Investors flock to gold as a secure store of value, driving up demand irrespective of interest rate movements.

-

Market Sentiment: Investor psychology plays a crucial role. Fear, uncertainty, and doubt (FUD) can trigger a rush to gold, regardless of interest rate levels. Conversely, periods of excessive optimism and risk-on sentiment might lead investors to favor higher-yielding assets, even if interest rates are low.

-

Central Bank Intervention: Central banks can significantly influence gold prices through their own buying and selling activities. Their interventions can sometimes counteract the effects of interest rate changes.

-

Supply and Demand Dynamics: The supply of gold is relatively inelastic, meaning it doesn’t readily respond to price changes. Therefore, changes in demand, driven by factors beyond interest rates, can significantly influence gold prices.

-

Long-Term vs. Short-Term Effects: The impact of interest rate changes on gold prices isn’t always immediate or uniform. The short-term effects might be dominated by market sentiment and speculation, while the long-term effects will likely reflect the fundamental relationship between interest rates, inflation, and the value of gold.

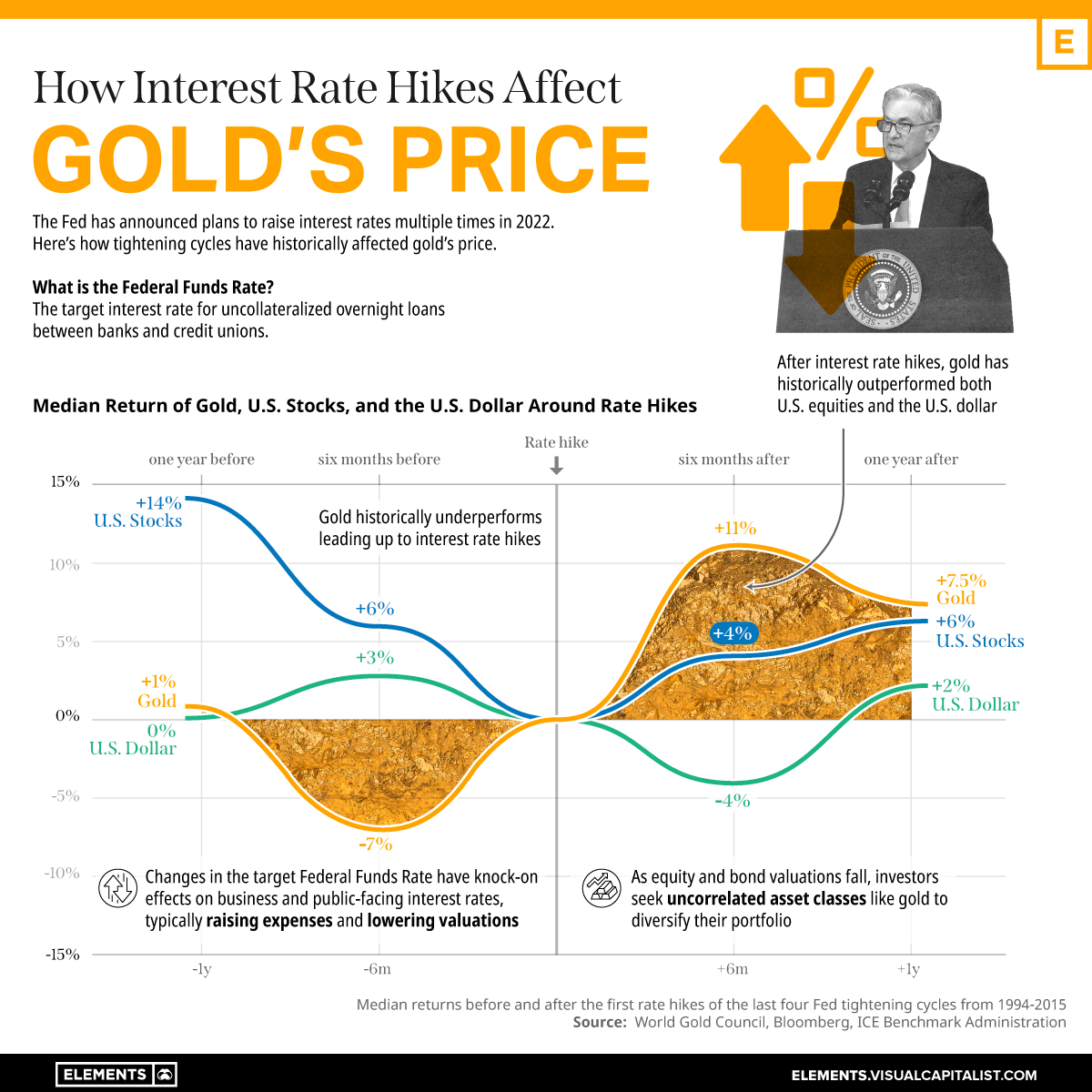

Interest Rate Hikes: A Closer Look at the Impact

When central banks raise interest rates, the impact on gold is usually multifaceted:

-

Reduced Speculative Demand: Higher rates make holding gold less attractive compared to interest-bearing investments, potentially leading to a reduction in speculative demand and price pressure.

-

Strengthened Dollar: Higher rates can attract capital inflows, bolstering the dollar and making gold more expensive in non-dollar currencies.

-

Inflationary Concerns (Potentially Offset): If rate hikes are successful in taming inflation, gold’s safe-haven appeal might diminish. However, if inflation persists despite rising rates, the demand for gold might remain high or even increase.

Interest Rate Cuts: Analyzing the Implications

Conversely, when central banks cut interest rates, the potential effects on gold are:

-

Increased Speculative Demand: Lower interest rates decrease the opportunity cost of holding gold, potentially boosting speculative demand.

-

Weakened Dollar: Lower rates might reduce the attractiveness of the dollar, potentially weakening its value and making gold cheaper for buyers holding other currencies.

-

Inflationary Fears: Rate cuts are often associated with easing monetary policy, which can fuel inflationary concerns. This can increase the demand for gold as an inflation hedge.

Investing in Gold: Navigating the Interest Rate Landscape

The dynamic interplay between interest rates and gold prices makes gold investment a complex endeavor. Investors need to consider various factors before making any decisions:

-

Diversification: Gold should be viewed as part of a diversified investment portfolio, not as a primary investment vehicle.

-

Risk Tolerance: Gold’s price can be volatile, so only invest what you can afford to lose.

-

Investment Horizon: Gold’s long-term performance has generally been strong, although short-term fluctuations can be substantial.

-

Macroeconomic Analysis: Keeping abreast of global economic trends, including interest rate movements and inflation expectations, is crucial for informed decision-making.

Conclusion: A Continuing Dance

The relationship between interest rates and gold prices is a complex dance, influenced by various economic and geopolitical factors. While a general inverse correlation exists, numerous exceptions and nuances exist. Investors should not rely solely on interest rate movements when assessing gold’s price trajectory. Thorough due diligence, considering multiple factors, and diversifying investments are essential for navigating the ever-evolving gold market. Understanding the intricacies of this relationship will enable investors to make more informed decisions, maximizing their potential gains while mitigating risks.

Closure

Thus, we hope this article has provided valuable insights into The Intricate Dance: How Interest Rates Sway the Gold Market. We thank you for taking the time to read this article. See you in our next article!