physical gold vs digital gold

Related Articles: physical gold vs digital gold

- 10 Stunning Gold Necklace Designs You Need to See in 2025

- Gold-backed Cryptocurrencies

- Daily Wear Gold Necklaces That Add Subtle Glamour

- How to Choose the Perfect Gold Necklace for Your Face Shape

- Gold As Inflation Hedge

Introduction

With great pleasure, we will explore the intriguing topic related to physical gold vs digital gold. Let’s weave interesting information and offer fresh perspectives to the readers.

Berikut ini adalah artikel tentang emas fisik vs. emas digital dengan sekitar 1600 kata, yang dirancang untuk SEO yang tinggi. Perhatikan bahwa optimasi SEO yang sebenarnya membutuhkan riset kata kunci yang lebih mendalam dan penerapannya ke dalam judul, subjudul, meta deskripsi, dan tag-tag lainnya. Artikel ini menyediakan kerangka kerja yang kuat untuk memulai.

Physical Gold vs. Digital Gold: A Comprehensive Comparison for Investors

The allure of gold, a timeless symbol of wealth and stability, has captivated investors for centuries. However, in today’s digital age, the way we invest in gold has evolved significantly. The traditional approach involves owning physical gold in the form of bars, coins, or jewelry, while a newer, more convenient option involves investing in digital gold. This article delves deep into a comprehensive comparison of physical gold versus digital gold, helping you determine which investment strategy best aligns with your financial goals and risk tolerance.

Understanding Physical Gold

Physical gold represents tangible ownership of the precious metal. This includes gold bars, coins, and jewelry. Each form has its own advantages and disadvantages:

-

Gold Bars: These are typically the purest form of gold, often reaching 99.99% purity. They are available in various weights, ranging from small gram bars to large kilo bars, offering investors flexibility in their investment size. However, they lack the numismatic value that gold coins might possess.

-

Gold Coins: American Gold Eagles, Canadian Maple Leafs, and South African Krugerrands are examples of popular gold coins. They offer not only the value of the gold itself but also potential numismatic value, depending on their rarity and condition. This can lead to price premiums above the spot price of gold.

-

Gold Jewelry: While undeniably beautiful and wearable, gold jewelry is often the least desirable form of gold for investment purposes. Its significant markup over the spot price and the presence of other metals in alloys significantly reduce its investment value. Furthermore, selling jewelry often involves significant losses due to lower resale prices.

Advantages of Physical Gold

-

Tangibility and Security: The most significant advantage is the tangible nature of physical gold. You physically possess the asset, providing a sense of security and control. This is particularly appealing to those who prefer a less abstract form of investment.

-

Hedge Against Inflation: Historically, gold has acted as a hedge against inflation, preserving purchasing power during periods of economic uncertainty. When the value of fiat currency declines, the value of gold often rises.

-

No Counterparty Risk: Unlike investments that rely on the solvency of a third party, physical gold ownership eliminates counterparty risk. You are not reliant on the financial stability of a bank, exchange, or other intermediary.

-

Potential for Numismatic Value (Coins): As mentioned, certain gold coins can appreciate in value beyond the spot price of gold due to their rarity and collectible nature.

Disadvantages of Physical Gold

-

Storage and Security Costs: Storing physical gold requires secure storage solutions, often incurring costs for safes, safety deposit boxes, or specialized vaults. Insurance is also crucial to mitigate the risk of theft or loss.

-

Liquidity: Converting physical gold into cash can be time-consuming and involve transaction costs. Finding a buyer who offers a fair price might require research and negotiation.

-

Transportation Risks: Transporting significant quantities of physical gold can pose security risks and logistical challenges.

-

Purity Concerns: It’s crucial to ensure the authenticity and purity of purchased gold bars and coins from reputable sources. Counterfeit gold is a serious concern.

Understanding Digital Gold

Digital gold represents ownership of gold without physically possessing the metal. It’s typically represented as a digital token or unit, reflecting the price of a specific amount of physical gold held by a custodian. Examples include gold ETFs (Exchange-Traded Funds), gold-backed tokens, and accounts with online brokers offering digital gold.

Advantages of Digital Gold

-

Convenience and Accessibility: Investing in digital gold is exceptionally convenient. Transactions can be conducted online, eliminating the need for physical storage and transportation.

-

Fractional Ownership: Digital gold allows for investment in smaller amounts than physical gold, making it accessible to investors with limited capital.

-

Liquidity: Digital gold is generally more liquid than physical gold, as it can be easily bought and sold on exchanges with minimal transaction costs.

-

Transparency and Tracking: Transactions and holdings are typically recorded on a transparent ledger, allowing investors to easily track their investments.

Disadvantages of Digital Gold

-

Counterparty Risk: Investing in digital gold involves trusting the custodian or intermediary holding the physical gold backing the digital representation. The financial stability of these entities is crucial.

-

Fees and Charges: Various fees can apply, including management fees, storage fees, and transaction fees, reducing overall returns.

-

Technological Risks: The digital nature of the investment exposes it to potential technological risks, such as hacking or system failures.

-

Regulatory Uncertainty: The regulatory landscape around digital gold is still evolving, potentially creating uncertainty for investors.

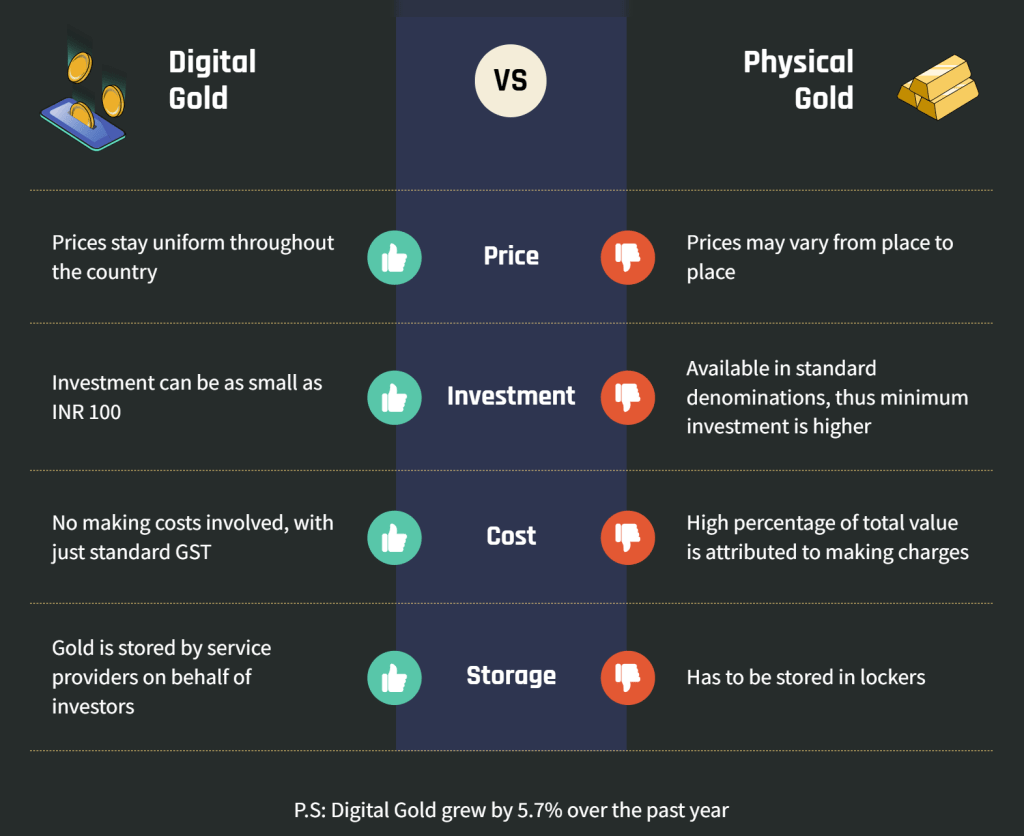

Physical Gold vs. Digital Gold: A Head-to-Head Comparison

| Feature | Physical Gold | Digital Gold |

|---|---|---|

| Ownership | Tangible ownership of the asset | Ownership of a digital representation of gold |

| Storage | Requires secure storage | No physical storage required |

| Liquidity | Lower liquidity | Higher liquidity |

| Counterparty Risk | No counterparty risk | Counterparty risk associated with custodians |

| Transaction Costs | Higher transaction costs | Lower transaction costs |

| Accessibility | Requires more capital for substantial investment | Accessible with smaller investment amounts |

| Security | Risk of theft, loss, and damage | Risk associated with platform security and hacking |

| Transparency | Less transparent | More transparent (depending on the platform) |

Which is Right for You?

The choice between physical gold and digital gold depends on individual circumstances, investment goals, and risk tolerance.

-

Physical gold is ideal for investors prioritizing tangible ownership, security, and a hedge against inflation, even if it means accepting lower liquidity and higher storage costs. This option is best suited for long-term investors with a higher risk tolerance but who value the security of holding the asset directly.

-

Digital gold is more suitable for investors who value convenience, liquidity, and accessibility. This option is more appropriate for short-term or medium-term investors who are comfortable with the counterparty risk associated with custodians and are less concerned about the tangible nature of their investment.

Conclusion

Both physical and digital gold offer distinct advantages and disadvantages. The optimal choice depends heavily on the investor’s risk profile, financial objectives, and investment horizon. Thorough research and careful consideration of individual circumstances are paramount before making an investment decision. Consulting with a financial advisor can provide valuable personalized guidance. Remember to always diversify your investment portfolio and avoid putting all your eggs in one basket, whether it’s physical or digital gold.

Closure

Thus, we hope this article has provided valuable insights into physical gold vs digital gold. We thank you for taking the time to read this article. See you in our next article!